Join us at Worlds of Fun on June 8th!

Join us at Worlds of Fun on June 8th!

We’re excited to invite our members to enjoy a fun day this summer! With 236 acres of rides and slides, Worlds of Fun and Oceans of Fun offers fun for kids of all ages and sizes. Please note that this event has limited space so that tickets will be given to members on a first-come, first-served basis.

-Each member is eligible to sign up for two tickets.

-A parking pass is included!

-Once all tickets are claimed, you can no longer redeem tickets through Eventbrite.

If you can't join us at this event, no worries! We will have more events that will be announced later this year. To stay current, check out our quarterly newsletter and events page on our website.

In consideration of being allowed to register for, and participate in, an event, activity, or experience (“Event”), I hereby waive, release from liability, assume all risks, and covenant not to sue Mainstreet Credit Union, or their respective members, employees, board members, agents, or volunteers for any expense, loss, damage, personal injury (including loss of life, disability, or serious harm), property damage or theft, negligence, or actions (each, a “Loss”) resulting from or arising in connection with my travel to, attendance at, or participation in the Event and any related activities. I am an adult of sound mind and capable of entering this waiver. I have read its terms and fully understand and agree to the provisions herein. I agree that this waiver shall be governed by and construed in accordance with the laws of the State of Kansas and enforced only in courts in the State of Kansas.

Home Improvement

Personal Loan vs Home Equity Line of Credit

When it comes to loans for home improvements you can choose between a personal loan or a Home Equity Line of Credit (HELOC). With our personal loans, you can receive funds faster and you don’t need to use your home as collateral. On the other hand, HELOC's generally offer lower interest rates, but they require your home to serve as collateral for the loan.

At Mainstreet CU, we’re here to help you find the personal loan or HELOC that’s right for you. With competitive rates and flexible terms, let’s get your remodel started today.

*Membership qualifications apply

Share Certificate Special

5.25% APY* for 7-Months

You work hard for your money. Now, make your money work harder for you with a Share Certificate. With as little as $500, you can start to see your savings grow faster. Take advantage of this special offer while it lasts.

Advertised rates and APY are offered at Mainstreet Credit Union’s discretion. Fixed and adjustable Certificate rates are not guaranteed until your Certificate is funded and issued. A $500 minimum deposit is required. Certificates have a maximum deposit amount of $250,000. Membership qualifications apply.

* The 5.25% APY (Annual Percentage Yield) promotional certificate has a term of 7 months, and the offer is effective as of April 1, 2024, and scheduled to end on May 31, 2024. Business accounts and corporate entities are not eligible. The promotional 7-month certificate will mature into a 6-month certificate at the then-current rate. Penalties may apply for early withdrawal. Fees could reduce earnings on these accounts. The offer is subject to change or may end at any time.

Federally Insured by NCUA

Business Loans Designed for Entrepreneurs Like You

Mainstreet's Business Services Team ensures your business is covered 24/7. Our accounts were created for small business owners like you. Our experienced team is here to help you if you are starting a business, your business is well established, or have questions along the way. Whether you need Equipment Financing, Commercial Real Estate Loans, or Commercial Vehicle Loans we are here to help. Contact one of us today!

Learn more about financial literacy in and outside of the classroom!

Mainstreet Credit Union is dedicated to our commitment to education by allowing teachers to use Banzai, a premium online financial literacy program, for free. To date, 217 teachers in the KCMO area have used Banzai to help 12,040 students learn more about financial literacy. To learn more about our financial literacy program and classroom presentations, contact jmiller@mainstreetcu.org.

Even if you aren’t a teacher, you are still able to access our Banzai materials to learn more about financial literacy. Learn how to budget, build credit, and plan for a financial emergency! Take control of your money and learn more today.

Even if you aren’t a teacher, you are still able to access our Banzai materials to learn more about financial literacy. Learn how to budget, build credit, and plan for a financial emergency! Take control of your money and learn more today.

Celebrate Financial Literacy Month

April marks the start of Financial Literacy Month, a nationally recognized movement to promote and support financial understanding in children and teens. For many, it's a fantastic opportunity to teach and connect with their children or grandchildren, and these kids are ready to learn! Recent data shows that nearly 74% of teens desire to be financially literate, and 86% want to learn how to invest.1

Teens tune in

Every parent has questioned if their child is actually paying attention. But rest assured, our children and grandchildren are listening: 75% of teens in America identify their parents are their most trusted source of financial education. In other words, our youngest savers and investors are looking to us for their financial education.1

How to start

It all begins with a frank conversation regarding finances. By demonstrating your openness to discussing what many consider a "taboo" topic, you're also modeling how to approach finances for your young learner. In time, they'll learn to view financial issues and goals clearly with as little unnecessary stress as possible.

A bright future

Financial literacy month has been shown to have a lasting, positive impact on our future investors. Children who are taught personal finance from a young age are more likely to secure lower-cost loans and grants when paying for college and less likely to rely on private loans or high-interest credit cards.2

If you decide to put your "teacher" hat on this month, let us know! We're always happy to help educate and support our future generations.

Mike Thornhill

Financial Advisor, CUSO Financial Services, L.P.

Mike.thornhill@cusonet.com

1 Greenlight.com, 2023

2 Investopedia.com, April 17, 2023

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Welcome Justin Geddie to Mainstreet Credit Union

Welcome Justin Geddie to Mainstreet Credit Union

Senior Vice President & Chief Retail Officer

Justin Geddie recently joined Mainstreet Credit Union as our Senior Vice President and Chief Retail Officer. Justin’s financial services career spans over 20 years. Most recently, he was the SVP of institutional and FinTech Banking Relationship Management at UMB Bank in Kansas City. Before that, Geddie served in retail leadership roles at UMB Bank, BBVA, and Wells Fargo Bank in Denver, CO. Looking forward, Justin is passionate about leveraging the momentum we have created towards our Vision of becoming the Financial Home of Every Member, including team building, leadership development, and fostering a culture of mutual respect and support for each other.

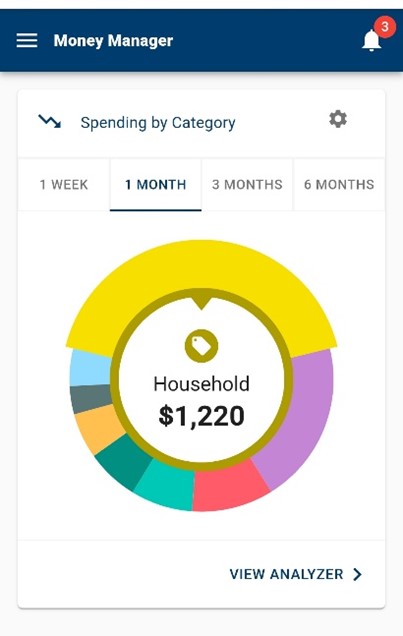

A new budgeting tool is coming to our app soon!

Get ready for a more innovative way to manage your money. With this tool, you can build a budget, stay on track, and set spending targets. Be on the lookout for the new app update this summer!

Experian Updates Coming Soon

This summer, your current and previous loan history from Mainstreet Credit Union will be displayed on Experian. Currently, we share this information with TransUnion and Equifax only. This new update will greatly enhance your credit history across all three credit bureaus, ensuring consistent reporting. If you have credit monitoring in place, you may receive notifications regarding a change in your credit history. There's no cause for alarm, though. If you notice any changes from Mainstreet Credit Union, simply review your loan information to ensure everything is in order. If you have any questions or concerns, please call our Member Assistance Center at 913-599-1010 or stop by your nearest branch.

Sign up for Estatements on Earth Day!

At Mainstreet Credit Union, we are committed to promoting sustainability and reducing paper waste. As part of our efforts, we encourage all our valued members to switch to eStatements and help us create a greener future. We can already see that the members who have signed up for eStatements are making a difference! Last year, Mainstreet reduced 16,024 pounds of carbon emissions from the environment. That's like taking one car off the road!

Later in 2024, we will continue to provide complimentary electronic statements (eStatements) to our members. As a means to support environmental sustainability and to control cost, we will introduce a fee for paper statements. Enrolling in eStatements is quick and easy. You can sign up through your OnlineAccess account by making sure your email address is up to date on your account. If you have any questions or need assistance, please contact us at 913-599-1010; our dedicated team will be happy to guide you through the process. Join us in our commitment to sustainability today