\

Frequently Asked Questions

Routing Number and Address

What Is Mainstreet Credit Union's Routing Number?

301079183

What is Mainstreet Credit Union's headquarters address?

13001 W. 95th Street

Lenexa, KS 66215

Lenexa, KS 66215

Getting Started

How can I become a member?

Visit our "Become a Member" page!

What Is Mainstreet Credit Union's Routing Number?

301079183

How old do I have to be to get a checking account with an ATM or Debit Card?

Members under age 18, who would like an ATM or Debit Card with their checking account, are required to have a parent or guardian as joint owner.

How will I receive my statements?

- Online - members can view their statements through OnlineAccess.

- By mail - members who have opted-in for printed statements receive monthly or quarterly statements, based on the type of account they have.

- Monthly statements are generated for members who have active checking accounts or have electronic transactions to their savings account.

How do I log in to OnlineAccess to access my accounts?

To reach the OnlineAccess login page:

- Visit the OnlineAccess portal

- Sign in using the green box in the upper left-hand section of our homepage

If you have not applied for OnlineAccess, please call the credit union at 913-599-1010 or 888-395-1010.

ATM/Card Management

How do I activate my Mastercard® Debit Card?

To activate your Debit Card, please have your card handy when you:

- Contact the Member Assistance Center at 913-599-1010 or (888) 395-1010

Can I choose my own PIN for my ATM/Check Card?

Yes, bring the card and your photo identification to one of our full service branches to have your card re-pinned or call 1-866-985-2273 from the phone number listed on your account.

Yes, bring the card and your photo identification to one of our full service branches to have your card re-pinned or call 1-866-985-2273 from the phone number listed on your account.

I want to report a lost or stolen Mastercard®. What should I do?

- Bring the card and your photo identification to one of our full service branches to have your card re-pinned

- Call 1-866-985-2273 from the phone number listed on your account

Can I make an ATM deposit?

Yes, all branch locations have ATM depository service. In addition, you can make deposits and payments in the Night Depository at our full-service branches and by mail.

Yes, all branch locations have ATM depository service. In addition, you can make deposits and payments in the Night Depository at our full-service branches and by mail.

OnlineAccess/Home Banking Compatibility Issues

I've forgotten my personal access code. How do I obtain a new one?

If you cannot remember your Personal Access Code, contact the Member Assistance Center at 913-599-1010.

For more assistance, please consult Bill Payer FAQs under the Online & Mobile Banking dropdown menu.

What does "Member Verification Error" mean?

As a security measure, access to your account is locked after a limited number of unsuccessful login attempts. Further attempts to login will fail, displaying the above message.

As a security measure, access to your account is locked after a limited number of unsuccessful login attempts. Further attempts to login will fail, displaying the above message.

To reset your password and unlock your account, contact the Member Assistance Center.

913-599-1010

(888) 395-1010 toll-free

9 AM - 5 PM, CDT

(888) 395-1010 toll-free

9 AM - 5 PM, CDT

Where can I find the latest issue of Mainstreet's newsletter?

Mainstreet Talk is published quarterly via email.

Mainstreet Talk is published quarterly via email.

To ensure you receive future emails, please make sure we have your preferred email on file. Simply log in to OnlineAccess to update your email address.

Why am I not receiving emails from Mainstreet?

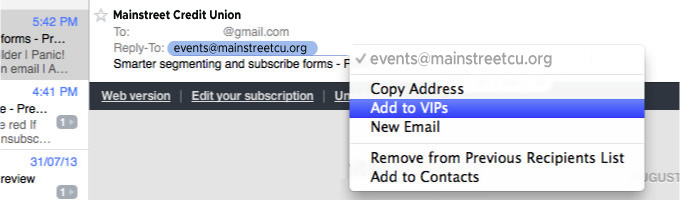

If you are having trouble receiving our emails or finding them in your spam folder, you may need to whitelist us. Whitelisting an email address just means you add them to your approved senders list. Doing this protects against overzealous spam filters.

If you are having trouble receiving our emails or finding them in your spam folder, you may need to whitelist us. Whitelisting an email address just means you add them to your approved senders list. Doing this protects against overzealous spam filters.

How do I whitelist Mainstreet Credit Union?

Whitelisting is a quick task to ensure the sender of an email gets added to the recipient’s safe senders list.

Whitelisting is a quick task to ensure the sender of an email gets added to the recipient’s safe senders list.

Here are simple instructions on how to ensure that our email lands in your inbox every time:

- Gmail

- Yahoo

- AOL

- Apple

- Android

Gmail

Getting all future emails from a sender to appear in the “Primary” tab (instead of “Promotions”) is a quick, two-step process.

Getting all future emails from a sender to appear in the “Primary” tab (instead of “Promotions”) is a quick, two-step process.

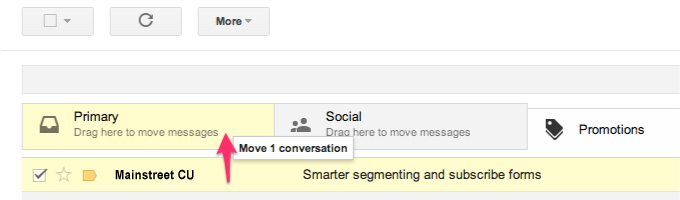

First of all, drag-and-drop the email message from beneath the tab it’s currently filed under, to the “Primary” tab:

.jpg)

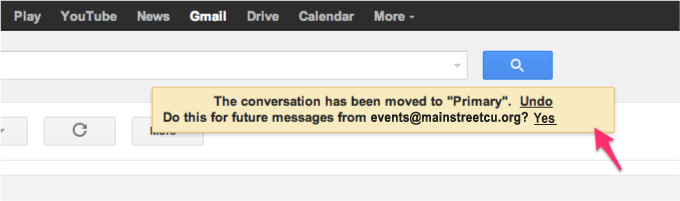

Once done, an alert will appear with, “This conversation has been moved to Primary. Do this for all future messages from sender@theirdomain.com?” Select “Yes”:

Yahoo

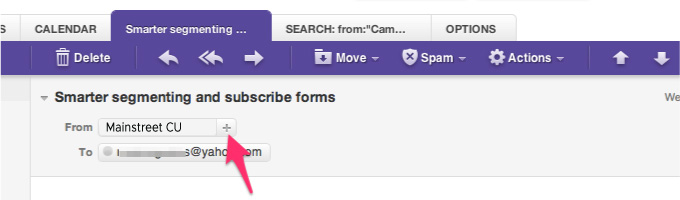

When opening an email message, a “+” symbol should display next to From: and the sender’s name. Select this and an “Add to contacts” pop-up should appear. Select “Save”:

AOL

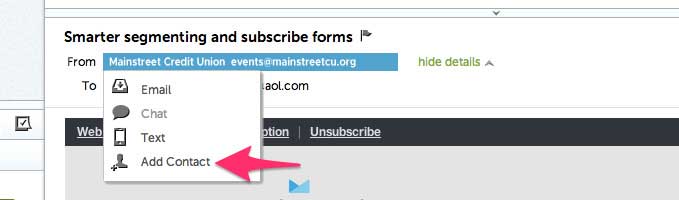

In the preview pane for an opened email message in AOL Mail, select the sender’s From name under the email’s subject line and select “Add Contact” from the drop-down menu:

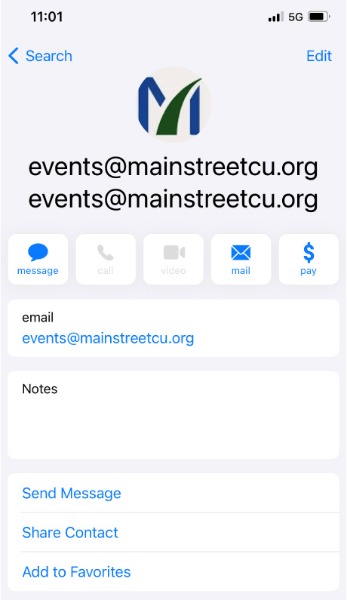

Apple Mail

By selecting the From, or Reply-to on an email message, you can choose to “Add to Contacts” or “Add to Favorites.”

Android

On Android devices, open the email message and touch the picture of the sender that displays before the message. Tap “Add to Contacts.”

On Android devices, open the email message and touch the picture of the sender that displays before the message. Tap “Add to Contacts.”

Digital Banking

I cannot connect to OnlineAccess. What should I do?

If you are experiencing difficulties logging on, contact the Member Assistance Center:

913-599-1010

(888) 395-1010 toll-free

9 AM - 5 PM, CDT

(888) 395-1010 toll-free

9 AM - 5 PM, CDT

MOBILE BANKING - GETTING STARTED

- Download the Mainstreet Credit Union app from the App Store or Google Play.

- Delete the MCU Mobile app.

Yes, the mobile app is compatible with iPhone and iPad devices running iOS version 11 or newer, and Android phones and tablets with version 5.0 or newer. Devices must have access to the internet.

How much does the Mainstreet Credit Union mobile app cost?There are no fees to download and use mobile app; however, connectivity and usage rates may apply. Contact your wireless service provider for more details.

Do I use the same user ID and password for the mobile app as I would for online banking?Yes, you will use the same user ID and password that you use to log in to online banking.

If I forgot my password, can I reset it within the app?Yes, you can easily reset your login credentials by clicking on the 'Forgot?' link on the mobile app.

How do I sign out of the mobile app?You will automatically be signed out once you swipe or close the app. Each time you access your app, you will be required to enter your passcode, use your fingerprint or utilize the facial recognition feature in order to log in again.

MOBILE APP - LOGGING IN

How do I access mobile banking?

Download the new mobile banking app from the App Store(opens in a new window) or Google Play(opens in a new window).

Download the new mobile banking app from the App Store(opens in a new window) or Google Play(opens in a new window).

Remove the old app: Be sure to delete the MCU Mobile app icon.

First-time login

If you are an existing mobile app user, you will automatically be prompted to download the new app. Or, simply search for Mainstreet Credit Union within the App Store or Google Play.

If you are an existing mobile app user, you will automatically be prompted to download the new app. Or, simply search for Mainstreet Credit Union within the App Store or Google Play.

Enter your existing Username and Password to sign in

Enter your email address and a phone number where you can receive a phone call to obtain a verification code.

Enter your email address and a phone number where you can receive a phone call to obtain a verification code.

Enter the verification code received and click “Verify.”

Review the User Agreement and click “Accept.”

You will be taken to new dashboard to begin your new mobile banking experience.

NOTE: It may take some time for balances to fill in after logging in the first time. If you see a $0 balance, please log out and log back in.

Review the User Agreement and click “Accept.”

You will be taken to new dashboard to begin your new mobile banking experience.

NOTE: It may take some time for balances to fill in after logging in the first time. If you see a $0 balance, please log out and log back in.

New app user set up

If you are a NEW mobile app user, search for Mainstreet Credit Union within the App Store or Google Play. You will need your member number and social security number.

If you are a NEW mobile app user, search for Mainstreet Credit Union within the App Store or Google Play. You will need your member number and social security number.

Create a Username and Password to sign in

Enter your email address and a phone number where you can receive a verification code.

Enter the verification code received and click “Verify.”Enter your email address and a phone number where you can receive a verification code.

Review the User Agreement and click “Accept.”

You will be taken to the dashboard to begin.

When I log into mobile banking, do I need to get a confirmation code every time I log in?

No. Check the “Don’t ask for codes again on this computer” box if you do not want to receive a confirmation code or phone call each time you log in. If you prefer to input a confirmation code with each use, you can leave the box unchecked or use the 2-Factor Authentication app to deliver the code.

NOTE:

If your browser is set to clear cookies every time, then clicking the button will not help. If you ever want to remove a device and reset your security settings, you can change them in settings once logged in to mobile banking.

If your browser is set to clear cookies every time, then clicking the button will not help. If you ever want to remove a device and reset your security settings, you can change them in settings once logged in to mobile banking.

How can I log in to mobile banking if I can't get a verification code through text message?

Two-Factor authentication uses a unique one-time access code to verify identity and log on to mobile banking. If you are unable to receive text (SMS) messages, you can choose to receive your access code via a phone call.

Two-Factor authentication uses a unique one-time access code to verify identity and log on to mobile banking. If you are unable to receive text (SMS) messages, you can choose to receive your access code via a phone call.

On the verification code screen click Try another way located beneath the Verify button

Select Phone Call and click Next

You will receive an automated phone call that will provide your access code (Have a pen and paper ready)

Return to the verification code screen

Enter your access code and click Verify

If you are still having trouble, contact the credit union to ensure we have the correct phone number on file.

Select Phone Call and click Next

You will receive an automated phone call that will provide your access code (Have a pen and paper ready)

Return to the verification code screen

Enter your access code and click Verify

If you are still having trouble, contact the credit union to ensure we have the correct phone number on file.

Can I use an email for two-factor authentication?

An email and a phone number are required for the two-step authentication. The one-time access code will be sent via text or phone call. The phone number must match our records for the additional security layer to work correctly.

An email and a phone number are required for the two-step authentication. The one-time access code will be sent via text or phone call. The phone number must match our records for the additional security layer to work correctly.

Why am I getting the mobile banking error: "Your account needs attention"?

This error is present during the log in process and typically means that your account has been locked. This can happen for a variety of reasons but is easily resolved. Please contact us via phone for assistance unlocking your account.

This error is present during the log in process and typically means that your account has been locked. This can happen for a variety of reasons but is easily resolved. Please contact us via phone for assistance unlocking your account.

Why am I getting the mobile banking error: "Please verify your information and try again"?

This error is present during the log in process and typically means that your credentials didn't match our records. Try entering your credentials one more time. If the error persists, please contact us via phone for further assistance.

This error is present during the log in process and typically means that your credentials didn't match our records. Try entering your credentials one more time. If the error persists, please contact us via phone for further assistance.

Why am I getting the mobile banking error: "Oops: The information you provided doesn't match what we have on file."?

This error is present during the log in process and typically means that your account information does not match our records. Please contact us via phone to confirm we have the correct phone number and username on record.

This error is present during the log in process and typically means that your account information does not match our records. Please contact us via phone to confirm we have the correct phone number and username on record.

I'm not able to log in to online banking when I click on the login button…

Often this is resolved by clearing your cache in Chrome to remove all cookies. If you need further assistance, please contact us.

Often this is resolved by clearing your cache in Chrome to remove all cookies. If you need further assistance, please contact us.

Why am I getting the mobile banking error: "Incorrect phone number"?

This error is present during the enrollment process and means that the phone number you entered does not match the phone number we have on file. If you have an alternative phone number, you can try again. If you would like to update your phone number in our system or need other assistance, please contact us.

This error is present during the enrollment process and means that the phone number you entered does not match the phone number we have on file. If you have an alternative phone number, you can try again. If you would like to update your phone number in our system or need other assistance, please contact us.

Why am I getting the mobile banking error: "Does not meet username or password requirements"?

This error is present during the enrollment process or when updating credentials. Click on Show Rules below the username and password field to see the credential requirements.

This error is present during the enrollment process or when updating credentials. Click on Show Rules below the username and password field to see the credential requirements.

Why am I getting the mobile banking error: "It looks like you've already enrolled"?

This error is present during the log in process and typically means that our records show that you have previously created an account with us. If you forgot your username and password, on the log in page click Forgot? Follow the steps to recover your account.

This error is present during the log in process and typically means that our records show that you have previously created an account with us. If you forgot your username and password, on the log in page click Forgot? Follow the steps to recover your account.

I can't remember my username name or password…

You can recover your account by going through the Forgot Password? steps.

You can recover your account by going through the Forgot Password? steps.

TRANSFERS/TRANSACTONS

Transfers/TransactionsHow do I make a transfer between my accounts in mobile banking?

To transfer between your Mainstreet Credit Union accounts:

- Log in

- Tap the slide-out menu > Transfer > Make a Transfer

- Select your To and From account and amount

- Click more options to change the frequency and date if desired

- Click Submit

Yes, all existing scheduled transfers in the previous mobile banking system have been moved to the new system.

My external transfers are not showing in the new app. Why is this?For a limited time, external transfers will not show in the mobile app. To access any existing external transfers, please log into Online Access.

NOTE: We expect this feature to become available when our Mobile and Online Upgrade is complete (expected June 8, 2021).

Where can I view pending transactions on my account?- Log in

- Select the account you are needing to view

- To view all account activity, view the Transactions tile in the mobile app

Account transactions can be searched in mobile banking by amount, date, tags, etc.

- Log in

- Select your account you want to search

- Select Transactions

- Tap the magnifying glass icon

- Tap the icon to use Advanced Search options

You can add notes, tags, and images to any transaction inside of mobile banking. To begin:

- Log in

- Click on any account

- Click on Transactions

- Select the Transaction you wish to edit and pull up the transaction’s details page

- Click on the appropriate icon for one of the following:

- Add Tags

- Add Notes

- Add Images

- Follow the on-screen prompts to update the transactions

- Tap < Transactions in mobile

Any tags, notes, and images attached to transactions will be accessible on all devices when you log in to mobile banking in the future.

NOTE: Transactions are available Mastercards or Mortgages through the “MyMastercard” or “MyMortgage”.

Alerts

Will my previously created account alerts work in the new mobile banking system?

No alerts will need to be re-entered in the new system. To set up alerts in mobile banking:

- Log in

- Select the account you would like to set up an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- In the Balance alerts section, select Add alert.

- Select Above or Below, and then input a dollar amount.

- In the Alert/Notify by field, select Email, Text message, or In-app message.

- Select Add Alert to save the alert

- Repeat steps for Transaction alerts

Alerts can be deleted at any time in mobile banking.

- Log in

- Select the account you would like to edit an alert for

- Click Alert preferences in the menu in mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Click the Trashcan icon or click Remove in mobile

Alerts can be edited at any time in mobile banking.

- Log in

- Select the account you would like to edit an alert for

- Click Alert preferences in the menu or Manage alerts in mobile

- Under Alerts

- Click Edit next the alert you would like to change

- Change your criteria for the alert

- Click Save

eSTATEMENTS

Will I need to re-enroll in eStatements with the new mobile banking?

No, you will not have to re-enroll in eStatements. If you have not yet enrolled in eStatements, we encourage you to do so. The new mobile banking site will make accessing your account and statement information easier than ever.

How do I view my account statements in mobile banking?Account statements can be viewed from mobile banking. These are only available for accounts already enrolled in eStatements.

- Log In

- Click on the slide-out menu

- Click on eStatements in the slide-out menu

- Click on Monthly Statements

- Click on the month you'd like to view

NOTE: Only the last 24 months of statements will show.

REMOTE DEPOSITS

If I am currently enrolled, do I need to re-enroll in mobile deposits?

Yes, re-enrollment is required for mobile deposits. Mobile deposit is available for all savings and checking accounts.

How do I make a mobile deposit in mobile banking?Mobile deposit is now available for all savings and checking accounts, but you must enroll first. Mobile deposit can only be done through the mobile app.

- Log in

- Select Deposit Check from the slide out menu in the mobile app

- Click Enroll Account and go through the sign-up steps

- Once your request has been processed and approved (typically approved the next business day), tap Deposit a Check

- Enter the check amount

- Tap Continue

- Select the account to deposit to

- Take a picture of the front of the check and tap continue

- Take a picture of the back of the check and tap continue

- Verify the information and tap Submit

Mobile deposit limits are based on the type of checking account you have. These limits include a daily dollar amount and number of items deposited daily. If you have specific questions, come in or call the credit union.

What should I do with my checks after using mobile deposit?You should retain the check for seven days after the deposit has posted to your account. After that time, you may shred it.

Is there a fee to use mobile deposit?

No, conducting a mobile deposit using the Mainstreet Credit Union mobile app is free.

Are there any limitations with using mobile deposit?

Yes, there are daily and monthly limitations to the number and dollar amounts that can be deposited through a mobile device. Contact Member Assistance at (913) 599-1010 for specific details.

NOTE: Members can access to any of their Mainstreet Credit Union accounts, excluding Certificates and Christmas Clubs. All IRA contributions are same year ONLY.

UPDATING INFORMATION

How can I change my phone number or email address in mobile banking?

You can update your phone number or email address in mobile banking.

- Log In

- Click on the User Profile icon and click Settings

- Click Edit next to your phone or email

- Verify your password

- Edit your contact information

- Click Save

Phone and email updates will happen immediately. All address updates will be reviewed by a member service representative and you may be contacted for additional information.

How do I change my username or password in mobile banking?You can change your username or password at any time in mobile banking.

To change username:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Username field select Edit

- Enter your current password when prompted

- Change your username and select Save

To change password:

- Log in

- Select your username icon in the top right corner or menu in mobile banking

- Select Settings and then select Security option on the left side menu

- In the Password field select Edit

- Enter your existing password, and then enter a new password

- Select Save

You can rename any account in mobile banking.

- Log in

- Select an account from the Accounts section

- Select Settings from the options menu

- Next to the account name, select Rename

- Type the new name, and then select Save

You can rearrange the order your accounts display in mobile banking to reflect the sequence you want.

- Log In

- From the Accounts click on the three dots and click Organize Accounts in online or click the opposing arrows in mobile

- Drag and drop the accounts to rearrange the order

- Click Done

THE DASHBOARD

How does my dashboard work?After successfully signing in, you will see your "Dashboard." A list of your accounts will be presented at the top. To view all accounts on one screen, select "View All." Below your account listing, "Quick Actions" are presented (Transfer, Pay, Deposit, Message). Under the "Quick Actions" icon you will find Payments, Transfers, etc.

Can I reorganize my dashboard?Yes! At the bottom of the dashboard, click "Organize dashboard" to drag and drop, delete or add information.

How do I set up an account alert?Select the account you would like to add an alert to and then select "Alert preferences." You may set up balance or transaction alerts based on low or high thresholds. You may choose to receive alerts by email, text or within the app.

Why are transactions labeled as pending?Transactions appear as pending until final processing occurs.

ADDING ADDITIONAL USER IDs

If I have multiple Online Banking accounts will I have to log in to each account with the usernames and passwords for each account separately?With our new mobile app, you can sign into multiple user-profiles and quickly switch between them using a PIN instead of entering a username and password. If you add more profiles to your mobile app, you will need to set up two-factor authentication (2FA) for each of them.

How do I add additional login profiles to my mobile app?- From the top of the menu bar press the person icon next to your profile name.

- Select Add profile.

- Sign in to the second profile.

- If prompted, answer the security question. If not, continue to the next step.

- If prompted, complete the profile information in the form, and then select Done.

- Enter a PIN for the new profile.

- Confirm the PIN for the new profile.

- From the top of the menu bar press the switch icon next to your profile name.

- Select the profile you wish to log into.

- Enter the PIN or use the fingerprint authentication if prompted.

TWO-FACTOR AUTHENTICATION (2FA)

Two-Factor Authentication (2FA) is a security feature that helps safeguard your account information. To implement 2FA, you will need to enroll an email address and a phone number (mobile or landline). Once this information is entered, you'll choose one of three options to receive a one-time verification code:

- Text message to the mobile phone entered, or

- Automated phone call to phone number entered, or

- Authenticator App. Download the Authy app

After entering the verification code from a secure computer, you have the option to select "Don't ask for code again on this computer." This allows you to avoid entering a verification code during each login. This option should never be selected on a shared or public computer.

How does the phone call verification process work?If you select to receive a phone call (cell phone or landline), you will enter a single specific digit, as directed, before the verification code is provided. Caller ID will show as "Digital Banking".

If you fail to answer the authentication phone call, you will need to select the option to have the code re-sent. The system will not leave codes on voicemail.

Note: The phone number used to send the verification code may not always be the same phone number but will always be sent from a US-based phone number.

What should I do if I did not receive a verification code to continue with the two-factor authentication enrollment?Please be sure the phone number you entered is correct. If it needs to be changed, contact our Member Assistance team at (913) 599-1010 during regular business hours.

How much time do I have to enter the verification code?Codes will expire within three minutes.

Can I lock myself out from entering an incorrect verification code?Yes. You can get locked out of the enrollment process if too many attempts are made with an incorrect verification code (more than six times in a single hour). You must wait an hour to try again following your first attempt. If you make more than 20 unsuccessful attempts in a 24-hour period, your login will be 'Suspended' and you will not be able to attempt again for 24 hours. If you have questions or need additional assistance, please contact our Member Assistance Center at (913) 599-1010 during our regular banking hours for assistance.

If I selected "Remember this computer," why am I being asked for a verification code each time I log in?There are several reasons you may be prompted for a verification code. This may include:

- logging in using different browsers

- deleting your browser history

- you have set your browser settings to delete your cookies and history automatically

Codes sent by email are not available, but can be received using one of the following options:

- Text message

- Phone call

- Authy App (A third-party app that generates a one-time passcode. To register you will need an email address and phone number.)

You can reset your own two-factor authentication enrollment in both the app and online by going to your Profile page, then select Security within the Settings area.

I’ve added more profiles to my account, do I need to set up 2FA for each account?Yes! If you’ve added more profiles to your mobile app, you will need to set up 2FA for each of them. If the account has already enrolled in 2FA, you will need the verification code sent to that user.

Loans

How do I get my loan balance?

You can use our mobile banking app, OnlineAccess through your PC, or PhoneAccess from a touch tone phone. You may also visit any branch or call our Member Service Center.

Can I set automatic payments for my loans?

Yes, automatic loan payments allow regular payments on a Mainstreet loan to be transferred from your checking or savings account. To set up automatic payments, call the Member Service Center or stop by any branch location.

OnlineAccess users may sign up for Bill Payer service. Bill Payer provides flexible options for paying Credit Union loans and other businesses or individuals. Learn more.

How can I place a stop payment on a check I have written that has been lost or stolen?

You can place a stop payment on a lost or stolen check that has not yet been presented for payment by phone or at any branch.

- By phone: Contact the Member Service Center

- Branch: Stop by any branch location

Stop payments placed through the Member Service Center or at a branch are assessed a fee of $20 per request.

Making A Payment

What account number should I use to set up automatic credits or debits?

You will need to provide your 13-digit account number which differs from your member number. A 13-digit number is needed for all automatic clearing house (ACH) transactions. You can find this at the bottom of your checks. From left to right you will see our routing number, a separator symbol, then your 13-digit account number.

Example:

What Is Mainstreet Credit Union's Routing Number?

301079183

301079183

How can I make automatic loan payments?

Automatic Loan Payments allow regular payments on a Mainstreet loan to be transferred from your checking or savings account. To set up automatic payments, call the Member Service Center or stop by any branch location.

OnlineAccess users may sign up for Mainstreet's Bill Payer service. Bill Payer provides flexible options for paying Credit Union loans and other businesses or individuals. Learn more.

How can I view my loan balance?

You can use our mobile banking app, OnlineAccess through your PC, or PhoneAccess from a touch tone phone. You may also visit any branch or call our Member Service Center.

How do I place a stop payment on a check I have written that has been lost or stolen?

You can place a stop payment on a lost or stolen check that has not yet been presented for payment by phone or at any branch.

- By phone: Contact the Member Service Center

- Branch: Stop by any branch location

Stop payments placed through the Member Service Center or at a branch are assessed a fee of $20 per request.

Mortgage

What are your current mortgage rates?

Rates change daily and are available by 10:00 A.M. Monday through Friday. You may also call Mainstreet at 913-599-1010 (toll free 888-395-1010). Our Call Center can provide rates, but if you have further questions you can ask for a member of the mortgage department.

What does it cost to submit a loan application?

There is no application fee for a pre-approval, however once a specific address is identified and before an appraisal is ordered, a $450 application deposit is collected. This application deposit is credited back at closing.

After I submit my application for a mortgage loan, what happens next

During your application appointment you will receive and review with your loan officer your Estimate of cash to close or Loan Estimate along with several other disclosures. We will then submit the loan to FannieMae's Desktop Underwriter for initial credit and underwriting approval. Processing follows when we may obtain additional verification of income or assets, order the appraisal and title work. The loan is underwritten and cleared to close. A closing appointment is scheduled and you are contacted to set up a convenient time to close at our office.

What if I just want to know how much I can afford? Do I have to apply for a mortgage to get "pre-qualified?"

A basic pre-qualifying exercise will give you a feel for how much home you can afford. We can help you estimate how much you can afford based on your current income and monthly obligations. Call us at 913-599-1010, or visit a branch to learn more about getting pre-qualified and pre-approved. Visit Mainstreet's mortgage page before you shop. Being a pre-approved buyer gives you the ability to make a qualified offer to purchase a home. A buyer with guaranteed funds has more leverage in a negotiation battle than the buyer who is still waiting to hear back from their lender.

Do I need to have a property selected before I can apply for the loan?

No, we often pre-approve members by having them complete a mortgage loan application before they shop for a home. Once your application is approved, you can select a home that is within the range of the dollar amount of your pre-approval.

Can I refinance my current mortgage with Mainstreet?

Yes, members can refinance for a lower rate, shorter term, or to get cash out for other needs. We can save members from paying many fees and associated closing costs as our costs are usually much lower than what other lenders charge. Call us at 913-599-1010 to learn more about how to refinance your existing mortgage.

Yes, members can refinance for a lower rate, shorter term, or to get cash out for other needs. We can save members from paying many fees and associated closing costs as our costs are usually much lower than what other lenders charge. Call us at 913-599-1010 to learn more about how to refinance your existing mortgage.

What does it mean to "sell my mortgage on the secondary market?"

Unlike the primary mortgage market between borrowers and lenders, the secondary mortgage market is where lenders and investors buy and sell existing mortgages. Selling mortgages allows Mainstreet to offer the products you want - long-term fixed-rate mortgage loans with low down payment options. By selling the loan in the secondary market, Mainstreet eliminates a significant amount of interest rate and/or portfolio risk.

How large of a down payment do I need?

Conventional - There is a 3 percent down payment requirement.

FHA - There is a 3.5 percent down payment requirement.

VA - No down payment required.

Mortgages with less than a 20 percent down payment require Private Mortgage Insurance to protect the lender against default. When considering the size of your down payment, consider that you'll also need money for closing costs, moving expenses and possibly repairs, decorating or appliances. Call us at 913-599-1010 to learn more about down payment requirements.

What happens on closing day?

On closing day the borrowers come to Mainstreet and sign the final settlement statement that itemizes all the final costs and credits associated with the mortgage loan, along with other loan disclosures. The lengths of time for closings vary but most usually are completed within 30 minutes. All disclosures will be explained and this is an additional opportunity to ask any questions and get clarification on anything that you don't fully understand. You will be signing a note promising to repay the loan and a mortgage or deed of trust (the security instrument). After signing, the mortgage and an instruction letter will be forwarded to the title company and recorded in the Register of Deeds office along with the Deed (if purchasing a home).

On closing day the borrowers come to Mainstreet and sign the final settlement statement that itemizes all the final costs and credits associated with the mortgage loan, along with other loan disclosures. The lengths of time for closings vary but most usually are completed within 30 minutes. All disclosures will be explained and this is an additional opportunity to ask any questions and get clarification on anything that you don't fully understand. You will be signing a note promising to repay the loan and a mortgage or deed of trust (the security instrument). After signing, the mortgage and an instruction letter will be forwarded to the title company and recorded in the Register of Deeds office along with the Deed (if purchasing a home).

What is a credit score?

A credit score is a score that attempts to condense a borrower's credit history into a single number that will predict the likelihood that a person will pay their bills as agreed. Points are assigned for different pieces of information such as payment history, length of time of residency and employment, length of time credit has been established, use of credit and any negative information such as late payments, collections, bankruptcies, and charge-offs. The score will range from 350 to 850, the higher the better. For mortgage loans, a score of 680 or above indicates a good score.

What is the difference between a home inspection and an appraisal?

A home inspection is performed for and with the buyer. The structural, electrical, and plumbing systems and appliances are inspected for condition and remaining useful life. The appraisal is done for the lender to estimate the market value of the property by comparing it to at least three recently closed sales. Mainstreet does not require, but highly recommends a whole house inspection. You are making a very large investment and need to know what you are buying. You have every right to have your questions about the property answered by a professional home inspector.

What does "retaining servicing" mean?

Retaining servicing means that Mainstreet will take care of your loan after closing. We receive and post your payments and pay taxes, homeowners insurance and mortgage insurance out of your escrow account (if you have an account set up for this purpose). We also perform annual escrow analysis, issue payoff requests (we don't charge any payoff statement fee or fax fee for this service) and perform collection activity if that becomes necessary. Retaining servicing is very important to us because it allows us to take care of our members after closing and do other nice things for you, such as paying dividends on your escrow account!

Retaining servicing means that Mainstreet will take care of your loan after closing. We receive and post your payments and pay taxes, homeowners insurance and mortgage insurance out of your escrow account (if you have an account set up for this purpose). We also perform annual escrow analysis, issue payoff requests (we don't charge any payoff statement fee or fax fee for this service) and perform collection activity if that becomes necessary. Retaining servicing is very important to us because it allows us to take care of our members after closing and do other nice things for you, such as paying dividends on your escrow account!

When can I "lock" my interest rate?

You can lock in an interest rate once we have the specific property address and are within 30-90 calendar days of a closing date. Locking commits Mainstreet to a specific interest rate for your loan. Rate locks are always done in writing with copies provided for the borrowers and Mainstreet. A roll-down fee to renegotiate your rate lock commitment is available.

What are junk fees?

The definition of junk fees will differ depending on who is asked the question, but in general refer to charges a lender assesses over and above real hard dollar costs. Junk fees may include underwriting fees, processing fees, courier fees, appraisal review fees, funding fee, shipping fee, administrative fee, broker origination, or processing fee. At Mainstreet, the only non third-party fees are a $825 origination fee charged on all loans and a reasonable $20 wire fee for outgoing wires when a wire can save the member money in delivering a payoff promptly. Mainstreet does not "farm out" the processing, underwriting, or closing functions. Mainstreet also does not and has never "padded" fees. We pride ourselves in having very low and reasonable closing costs.

I've heard that you shouldn't refinance unless you are lowering your interest rate at least 2%. Is that true?

Absolutely not! That was a true statement when houses were $30,000 each, but it is no longer the case. The smaller your mortgage the truer it is, however, because a smaller balance results in fewer savings. Have your loan officer calculate the cost of the loan versus the savings and the period of time it will take you to recoup the expenses of the refinance. This should help you decide whether it's worthwhile or not, and it will only take the loan officer a few minutes to calculate.

Why should I choose a Fixed/ARM (3/1 or 5/1 Products), and what are the advantages?

- You plan to own your own home for only a few years (3 to 6), and/or

- You want to lower initial monthly payments more than a traditional 30-year fixed-rate mortgage offers, and/or

- You need a lower initial monthly payment to qualify for a larger loan &/or buy more home, and/or

- You are a first-time home buyer and need the lowest payment to start out in your new home.

What is a Fixed-Rate Mortgage Loan?

You pay a predetermined interest rate for the duration of the mortgage. Mainstreet offers you a choice of 10, 15, 20 or 30-year terms. You will pay more interest over the term of the 30-year mortgage but your monthly payments are lower than the shorter-term fixed-rate loans that we offer. With the 10, 15 or 20-year mortgage, you have a higher monthly payment but you build up the equity in your home faster.

First Mortgage OnlineAccess

Where can I access my mortgage online?

Clicking on My Mortgage(opens in a new window) to bring up the log-in screen:

What information is required from new users to log in?

You will need your Social Security Number and your mortgage loan number. At the log-in screen, click on the link for new users, enter your Social Security Number and mortgage loan number, and then create a user name and password.

I am trying to access my mortgage online and all I see is a white screen. How can I fix this?

This problem has been experienced by some users. If a white screen only appears after clicking the access link, please press the "F5" key on your keyboard, or click the "Refresh" button on your web browser.

This problem has been experienced by some users. If a white screen only appears after clicking the access link, please press the "F5" key on your keyboard, or click the "Refresh" button on your web browser.

How do I access my mortgage online if my web browser is set to not accept any "cookies?"

A cookie has to be downloaded to the computer to allow online access. The cookie name to be installed is "estatus@loanware.com."

Scheduling Appointment

What is Appointment Concierge?

Appointment Concierge is a program that allows members to schedule branch appointments using a mobile device or online. Interact with branch staff efficiently, avoid long wait times, and speak to the right employee the first time.

Appointment Concierge is a program that allows members to schedule branch appointments using a mobile device or online. Interact with branch staff efficiently, avoid long wait times, and speak to the right employee the first time.

What branch appointments can I make using Appointment Concierge?

Appointments can be made as quickly as 1 hour in advance and looking up to 2 weeks out in the calendar. Some appointments are available by phone or in-person, while others are phone-only appointments.

Appointments can be made as quickly as 1 hour in advance and looking up to 2 weeks out in the calendar. Some appointments are available by phone or in-person, while others are phone-only appointments.

Services available

CARD SERVICES

- Get assistance with ATM, Debit or Credit Cards

- Get assistance with ATM, Debit or Credit Cards

NEW ACCOUNTS

- Open a new membership

- Open a savings, checking, IRA, Youth or Business account

- Open a savings, checking, IRA, Youth or Business account

LOANS & MORTGAGES

- Purchase or finance vehicles, Harleys, ATVs or motor homes

- Meet with a representative to borrow money for nearly any purpose

- Apply for a MasterCard credit card and borrow money as you need it

- Discuss options to borrow against your home’s equity

- Discuss your business lending needs with a representative

OTHER FINANCIAL NEEDS

- Meet with a representative to borrow money for nearly any purpose

- Apply for a MasterCard credit card and borrow money as you need it

- Discuss options to borrow against your home’s equity

- Discuss your business lending needs with a representative

OTHER FINANCIAL NEEDS

- Schedule a call or in-person appointment to update your account information

- Get help accessing your online account, mobile app or other online features

- Make an appointment to get your business or personal documents notarized

- Transfer money to an individual or entity

- Place a stop payment on a single check, ACH or a series of checks

- Schedule time to access your safe deposit box

- Get help accessing your online account, mobile app or other online features

- Make an appointment to get your business or personal documents notarized

- Transfer money to an individual or entity

- Place a stop payment on a single check, ACH or a series of checks

- Schedule time to access your safe deposit box

How do I schedule an appointment?

Click here to schedule an appointment.

All appointments can be made online using your smartphone, computer or tablet. Once you have scheduled the appointment, a confirmation email will be sent to the email address you provided.

All appointments can be made online using your smartphone, computer or tablet. Once you have scheduled the appointment, a confirmation email will be sent to the email address you provided.

What if I cannot make it to my scheduled appointment?

You can cancel or reschedule your appointment from the confirmation email you received.

Should I purchase or download anything to attend the meeting?

You will receive a confirmation email once you have successfully scheduled your appointment. We recommend signing up for text message reminders prior to your appointment time. Select Receive text message confirmation and reminders on the confirmation page to sign up for these reminders.

You will receive a confirmation email once you have successfully scheduled your appointment. We recommend signing up for text message reminders prior to your appointment time. Select Receive text message confirmation and reminders on the confirmation page to sign up for these reminders.

What if I would like to meet with my favorite representative?

You can choose a specific representative to meet with if there is one you’re more familiar with.

You can choose a specific representative to meet with if there is one you’re more familiar with.

What other information should I know before I arrive to my appointment

- Bring any documents that you may need for your appointment.

- Parking looks a bit different at each branch so look for any signage that helps guide you to the right location for parking.

- When you arrive, someone will be available to help check you in when you arrive.

I’m having trouble accessing the program on my laptop or tablet. What do I do?

Double check the browser you are using. To access Appointment Concierge with ease, Mainstreet members should use the Google Chrome browser. You can download Google Chrome here.

Double check the browser you are using. To access Appointment Concierge with ease, Mainstreet members should use the Google Chrome browser. You can download Google Chrome here.

I’m having trouble scheduling my appointment. What do I do?

If you are experiencing difficulties with Appointment Concierge, you can also contact our Member Assistance Center at (888) 395-1010.

If you are experiencing difficulties with Appointment Concierge, you can also contact our Member Assistance Center at (888) 395-1010.

Fraud Information

Spoofing is when a caller deliberately falsifies the information transmitted to your caller ID display to disguise their identity. Scammers often use neighbor spoofing so it appears that an incoming call is coming from a local number or spoof a number from a company or a government agency that you may already know and trust. If you answer, they use scam scripts to try to steal your money or valuable personal information, which can be used in fraudulent activity.

Reminder:

Mainstreet Credit Union will NOT contact you requesting you to share account information. Fraudsters can spoof real numbers (including your credit union’s phone number), and falsely claim that there has been potential fraudulent activity on your account, in an attempt to scare you into providing your account information.

If you are contacted by someone asking you to provide passwords or any information that appears on your debit, ATM, or credit card (such as card number, CVV number, expiration date, etc.), DO NOT share anything with them. HANG UP IMMEDIATELY. Remember these fraudsters can mask phone numbers and make it appear as though they are calling from a valid number, even a Mainstreet Credit Union number. If you are unsure whether the representative calling you is from Mainstreet Credit Union, hang up and contact us at (913) 599-1010 or toll-free (888-395-1010) or stop by a branch so we can review your account activity with you.

Federal Holidays

All Mainstreet branches will be closed on the following days.

2025

- New Year's Day - January 1

- MLK Day - January 20

- President's Day - February 17

- Memorial Day - May 26

- Juneteenth- June 19

- Independence Day - July 4

- Labor Day - September 1

- Columbus Day - October 13

- Veteran's Day - November 11

- Thanksgiving Day - November 27

- Christmas Day - December 25

*Holiday falls on a Saturday

**Holiday falls on a Sunday. Branches will be closed on the following Monday.

Bill Payer

What is Bill Pay?

Bill Pay allows you to pay anyone, anywhere right from your computer or mobile phone. There is no limit to the number of bills you can pay, and this service is free to all members with a checking account.

How do I register for Bill Payer?

You may register for Bill Payer online. The online method is invoked the first time you attempt to access Bill Payer. First, you will be requested to read and accept Mainstreet Credit Union's authorization disclosure. Failure to accept the disclosure terms prevents the registration process from proceeding. After the disclosure is agreed to, you complete an online registration form. After submission, the registration form is electronically forwarded to Mainstreet Credit Union for review. Mainstreet Credit Union is responsible for checking the information submitted and for assigning the payment plan. For more information call 913-599-1010.

If you try to enter Bill Payer during the application-processing period, you will be shown a page requesting that you wait for the acceptance notification.

Can I use Bill Payer with all my accounts?

No, only a single checking account may be used for payments.

Is there a limit to the number of Bill Payer accounts I can set up?

Yes, you are limited to one Bill Payer account.

When is Bill Payer available?

You may schedule payments 24 hours a day, seven days a week.

How are Bill Payer transactions reflected on my checking account?

All Bill Payer transactions are reflected as an ACH debit on the account statement.

When are funds debited from my checking account?

On the process date, the Bill Payer processor generates an ACH debit (in the amount of the bill payment) to your checking account. Your checking account will be debited within two banking business days.

What do payees actually receive?

Electronic payees receive payment information in an electronic format that credits their account. Non-electronic merchants or individual payees receive a laser-printed paper check sent through the U.S. Postal Service.

When may bill payments be scheduled for processing?

The Bill Payer processor processes payments on all days excluding Sundays and Federal Reserve Board recognized holidays. In cases where a payment gets scheduled on a Sunday (this can potentially happen on a recurring payment), the payment is processed on the day before (Saturday). If you happen to be setting up the payment on this particular Saturday, the bill payment will be processed on the next banking business day. Also, please note that weekly recurring payments may not be scheduled on Saturdays.

What bills may I pay through Bill Payer?

- You may pay practically anyone in the 50 United States and territories who can accept a check using Bill Payer - utilities, auto loans, even doctors and day-care centers. There are, however, organizations that will not accept payments via Bill Payer, such as the IRS and other taxing entities, and court directed and government-related organizations.

When may I begin using Bill Payer?

- Once you receive a confirmation e-mail informing you that you are now activated, you may begin using Bill Payer. This process takes approximately two to three business days.

When can I use Bill Payer?

- You may schedule payments 24 hours a day, seven days a week. Payments scheduled on a Saturday, Sunday, or holiday will be debited from the account the next business day.

How many days does it take for a payment to reach the payee?

- Payment processing takes three to five working days. The main variable in processing time is whether the payee accepts electronic Bill Payer or requires a physical check. The customer must allow three business days for electronic payments to be received and five business days for checks to be received.

What happens if there are non-sufficient funds (NSF)?

- If there are non-sufficient funds, the debt will be returned to the Bill Payer provider via banking channels. The ACH return will prompt the system to block your account, preventing you from making more payments until the NSF is resolved. Any recurring future dated payments scheduled for release during the time the account is blocked will not be sent.

BILL PAYER - MOBILE BANKING

You can use mobile banking to pay a bill or pay a person.

- Log in

- Select Pay under your account in mobile

- If it is your first-time using Payments, it will ask you to enroll, click Enroll

- Select the merchant or person you would like to pay

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment, Select More options and select the desired date

- Select Submit

You can use mobile banking to pay a bill or pay a person.

- Log in

- Select Pay under your account in mobile

- If it is your first-time using Payments, it will ask you to enroll, click Enroll

- Select Pay a person > Person to pay (To add a new person, select Add another person and fill out the necessary information) or Select the person to pay in mobile

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment, Select More options and select the desired date

- Select Submit

Sign up for e Statements

- Log into your OnlineAccess

- Select eStatements in the menu located on the left hand side of the screen.

- Choose the option to sign up for eStatements

How your funds are Federally Insured

Why do I need to input my username when signing in with a passkey?

Since our members can sign into multiple profiles with one device, each profile has its own username and login rules.

For example, if a member has a Business and a Personal profile. They may want their Passkey registered on their profile but not their Business profile.

What has changed in online banking?

Our new online banking tools bring all your accounts and financial information into one place and offers new budgeting and spending tools to help you stay on top of your finances.

With Insights PFM (Personal Financial Management), you can:

- See your transactions automatically categorized and graphically displayed in the account summary page.

- Change and/or exclude transaction categorizations from your spending analysis.

- Create and manage budgets based on your spending habits.

- See all your accounts in one place by linking accounts you hold at other financial institutions.

- Add assets and liabilities (e.g. car, home, or even money under the mattress) so you can see a more complete picture of your finances.

- Create account groups so that transaction history and spending analysis for related accounts can be viewed together.

- View your spending and budgets using Online Access and our Mobile app.

How is this different from Mint.com or other personal financial management tools?

Mint.com is a third-party software provider that allows customers to aggregate their financial information and is not a financial institution. It does not allow users to perform any online banking activities, such as pay bills or transfer money. Insights PFM is fully integrated with our online banking platform and offers easy-to-use tools to help you see your full financial picture, within a platform you know and trust.

How often is account information updated in Insights PFM?

Online Banking account information is updated in Insights daily.

How do I use Insights PFM?

If you have a registered Online Access User ID, there are several ways that you can add external accounts.

- Select Insights in the Menu and then click on “Link Account” within the menu.

- Second, select the Account options on the Dashboard and click “Link an Account”.

Is there a fee to use Insights PFM?

Insights is available free-of-charge to all our members.

Is my information safe?

Keeping your financial information safe and secure is very important to us. Our online services offer you the best security currently available in a commercial environment so that your personal and financial information is protected.

I have accounts that I don’t want factored into my budgets/income.

Some institutions choose to send all the accounts that you are associated with in the data feed when your accounts are initially linked. This is a great benefit to allow you to see everything in one spot, but it may be more than what you want. You may be associated with an account for your child, spouse, or business that you don’t want to show in your personal budgets.

The exclude account button will help you keep track of totals and view transactions, but the transactions aren’t calculated into any of your other views. This will help you to see exactly what you want to see!

I can’t find my credit union, bank, credit card or financial institution.

The following steps may help:

- Try searching for the URL instead of the name.

- Make sure you are entering the name correctly. (i.e. Wells Fargo not Wellsfargo)

- Instead of searching for the generic term 'Master Card', search for the issuer listed on the back of the card.

Can Insights PFM be used by Commercial customers?

The Insights PFM tool is specifically designed for consumer use and not for the level of data or transaction volumes typically associated with larger commercial accounts. The product’s budgets and categories are set up around personal/consumer-specific needs (personal care, kids, shopping, etc.), and the tool doesn’t offer categories that would be relevant for commercial use. Although Commercial customers can see the tab their Sub-Users cannot.

Why do I get a blank page when I click on the Insights PFM tab?

You may be using an unsupported browser. IE9 and current versions of Firefox, Chrome, and Safari are supported. Older versions may work; however, support will not be provided for them. IE 10 will be supported once it gains critical mass with the market.

How does automatic categorization work?

When transactions are imported, they are auto categorized based on previous categorizations of similar transactions as well as those of other authorized users. The process is an estimate based on trends and characteristics of the transaction. The authorized user also has the option to review and re-categorize where needed. When you change a transaction category, Insights PFM will remember your preference for next time.

Help, the delete button doesn't appear on certain accounts!

It is true, for certain accounts a delete option will not appear. If the delete option doesn't appear this means that the account was automatically added by your home institution. These accounts cannot be deleted; however, they can be excluded. Excluding an account hides that account, its transactions, and its balance from your view in the software apps. This essentially "deletes" the account with the option to re-include it in the future if it ever becomes necessary.

How do I delete an account?

You may have added an external account that is no longer needed, or an account may automatically sync that you don’t want to factor into your financial picture. Either way, you’re in control and can remove it.

*Note: Deleting the account is different than deleting an institution connection. If you delete the account, only that account will disappear, and the connection will persist. If you delete the institution connection, however, it will delete all the accounts beneath that connection. The steps for deleting the connection are also included below.

Deleting an Account

- Select ‘Accounts’ from the top navigation bar.

- Select the account you want to delete from the page.

- Click on the trash can icon at the bottom right-hand corner of the account detail box.

- The ‘Delete This Account’ window will pop up.

- Click on Delete.

- Deleting an Institution

- Click on Manage Institutions in the top right of the screen.

- Find the Institution you wish to remove.

- Click on the trash can icon on the right-hand side.

- Select Delete Institution.

*Note: You will not have the option to delete your home institution.

What should I do if my institution is not supported?

If you are unable to locate your institution, select the Help (?) icon located in the top menu. From there you can submit a request by clicking on the "Submit a Support Request" option at the bottom. Please submit the name you searched for, the complete institution name, their URL and any other additional details you can provide.

There are many types of online banking accounts, and not all are compatible with common aggregation methods. The Insights PFM provider utilizes multiple aggregation sources and uses an aggregation engine to provide the best possible coverage, but when an unsupported institution is encountered, a manual account can be created in the Accounts widget.

Due to factors outside our control, including approval of the financial institutions themselves, we cannot guarantee that your institution will be supported, but we will do our best. We add support for more banks and credit unions all the time.

How will I be contacted when I submit a support request?

You will be contacted through the e-mail address listed in your ‘Profile’.

I'm having problems with the security challenge questions when adding an account.

Here are a few tips that might help:

- Answer as many questions as you put on file when you registered with your financial institution.

- The number of questions you need to answer may be less than the number of form fields displayed on the page.

- For some financial institutions, the questions and answers need to be in the exact same order as they are listed on your financial institution site.

- If you've forgotten the questions, you can try logging into the online banking at your institution's website or calling their online banking support, to retrieve them.

- Answers to these questions may be case-sensitive. i.e. 'Cat' will work, while 'cat' will not.

How do I add an asset, like my home or vehicles, to balance my loans in net worth?

Open “Insights” go to Net Worth section and click on ‘View Net Worth’ and add Asset, then enter the account details and click ‘Save It’.

How do I budget for paying off debt?

If you are working on paying off a credit card, congratulations! We recommend that you create a custom subcategory to track your progress, such as Bills & Utilities: Credit Card Payoff. This will allow you to see in Spending and Budgets how much you have spent towards paying down that debt.

It is recommended that you do not use your card for purchases while you are paying it off. Not only will it be easier to stick to your goal if you just don’t use the card, but it is more difficult to account for your credit card payoff if you are actively accruing debt on the card.

If you must use your credit card while you are paying it off, you can split the transaction between Transfers: Credit Card Payment for the portion that pays back what you spent, and Bills & Utilities: Credit Card Payoff for the amount that will be applied to the previous balance.

If you also want to track separately how much of your credit card payment is applied to interest vs. what you owe, see “How do I account for interest paid on a loan?”

For an assortment of financial calculators, including loan/mortgage payoff, please visit our website at mainstreetcu.org to select Tools & Resources > Financial Calculators.

How do I use the spending wheel?

The Spending Wheel displays your spending across all categories for the time period selected. Use the date range selector to specify what date range you would like to view.

You can click on a category from the list, or in the wheel, to view your subcategory spending. Then click the center of the wheel or from the list to view the specific transactions in the selected subcategory.

*Note: Your transactions must be categorized for the Spending Wheel to show actual spending. If your spending in a given category looks wrong, review your transactions for inaccuracies.

I’m missing a category from my Spending Wheel or Budgets. I know I have transactions in this category, but it’s not appearing. How do I fix this?

Review your transactions to make sure they are categorized correctly. A “missing category” is caused by a large income transaction that has been categorized inappropriately.

How do I use budgets?

Budgets can help you track and control your spending in select budget categories. You can use budgets to track all of your regular household expenses, or just specific categories that you want to monitor more closely. Budgets are useful for setting and working towards financial goals, or simply being more aware of your spending habits.

How long will the transactions remain in the Insights PFM tool? How much history will the consumer be able to see with internal accounts and external accounts?

When accounts are initially added to an external account, an initial request of 90 days of history will be made. After the initial account setup, Insights PFM will pull new transactions from the last 30 days, so you must sign in at least once every 30 days to avoid creating a gap in your data.

When the consumer accesses the account each day the account will be updated with the recent transactions for the account. Currently there is no limit to archival history.

How do I create a Pay Off Loan in Insights?

In the Goals Section Click Pay off Loans

- Choose the account you would like to pay off . (This includes both internal and external accounts).

- Choose a complete by date

- It will give you a goal summary at the bottom what amount you are paying off and how much you need to pay per month to meet your goal by the complete by date.

How do I add Goals?

Click here for a step-by-step tutorial on how to update your goals on Insights.

Pennies

Times are changing. As the economy evolves, the U.S. Department of the Treasury has announced it will stop producing the penny.

How will the end of the penny affect members?

- We are no longer able to order pennies from the Federal Reserve, which limits our ability to fill change orders that include them.

- Rolls of pennies are no longer available at our branches.

- Cash in your pennies sooner rather than later. While no official date has been set, there may come a time when Mainstreet will no longer accept pennies for deposit.

- Expect rounding – we will round down to the nearest five cents.

- Use digital payments – card and mobile transactions will continue to process to the exact cent and are not affected by rounding.

- When closing an account, if your final balance includes 1–4 cents, the amount will be rounded down. You may request a cashier’s check for the exact amount or choose to donate the remaining cents to Children’s Miracle Network.